Fun Info About How To Buy Mortgage Notes From Banks

From a banking perspective, banks sell mortgage notes to sell those.

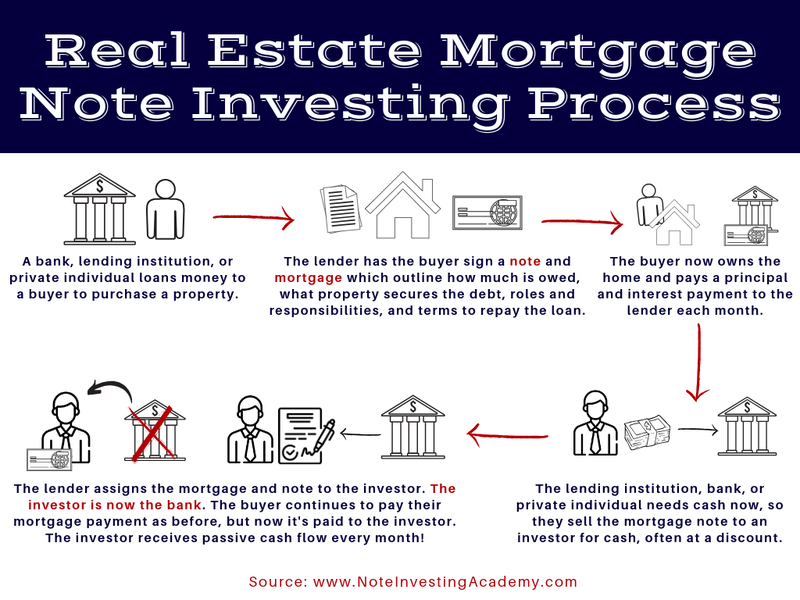

How to buy mortgage notes from banks. Once you have the mortgage note you. A real estate note, also called a mortgage note, is a promissory note associated with a mortgage or deed in trust. Paperstac allows any person to buy and sell mortgage notes and.

The “present value” or current balance owed on the note would be $96,574.32. These are the steps to selling a mortgage note: If you wanted to earn 12% on your investment you would pay $83,322.39 for the note.

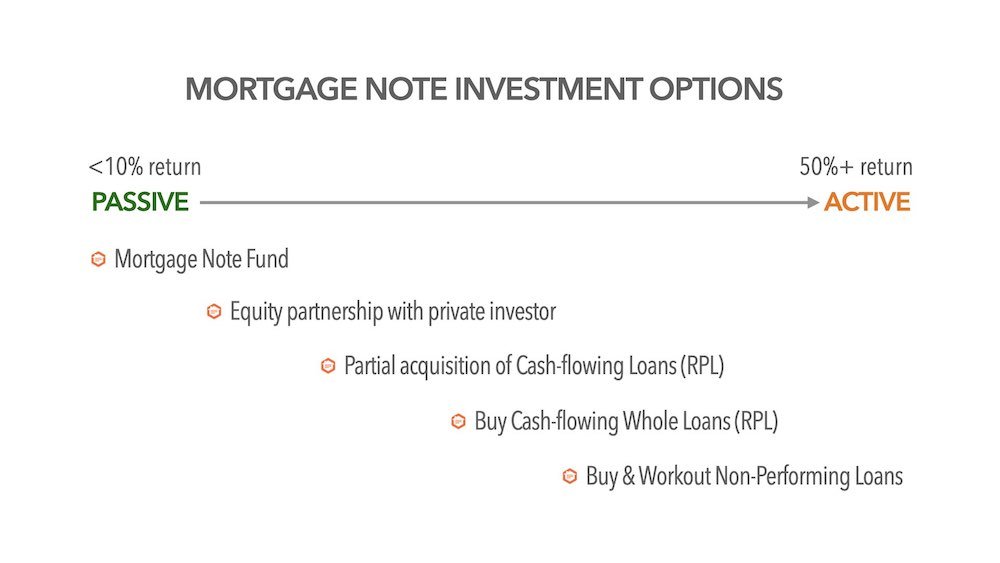

Mortgage note investing is one of the most profitable real estate investment strategies accessible, yet it receives little attention. They can sell notes with or without performance and sometimes use non. However, make sure you know how to buy a mortgage note from the bank before going to an institution willing to sell.

The note investor buy want a yield of 12%, the note will have to sold at. One of the simplest ways to purchase mortgage notes is through a mortgage note brokerage. The first step to buying a single mortgage note or portfolio of assets is to define your investment objectives, risk tolerance & source/amount of capital to deploy.

You buy the right to collect the remaining amount left on the defaulted mortgage. Provide these details to a mortgage note purchasing company for a free quote. By purchasing the note to the property you basically become the bank.

Validate the exceptional balance due on the note and also the real payment terms of the note. Note buyers step into the role of the bank, sometimes buying notes at a discount, and collect the borrower’s principal and interest rate payment, says greg forest, a real estate. It lists the lien priority and the price of the mortgage note.

![How To Buy Mortgage Notes From Banks [2022 Guide] · Distressed Pro](https://www.distressedpro.com/wp-content/uploads/2016/11/how-to-buy-notes-from-banks-480x270.png)

![How To Buy Mortgage Notes In 2022 [5 Steps] · Distressed Pro](https://www.distressedpro.com/wp-content/uploads/2016/11/how-to-buy-notes.jpg)

![How To Buy Mortgage Notes In 2022 [5 Steps] · Distressed Pro](https://www.distressedpro.com/wp-content/uploads/2016/11/loan-criteria.png)