Have A Tips About How To Sell A Covered Call

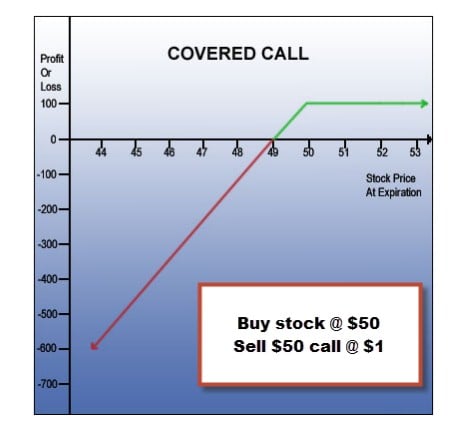

So you would sell a call to open your position.

How to sell a covered call. As options represent the right to buy or the obligation to sell shares in 100 share blocks, you’d need a minimum of 100 shares to sell one call option. In order to sell covered calls, you have to own 100 shares per contract you sell of the underlying stock. Ad learn how to spot ideal times for covered calls.

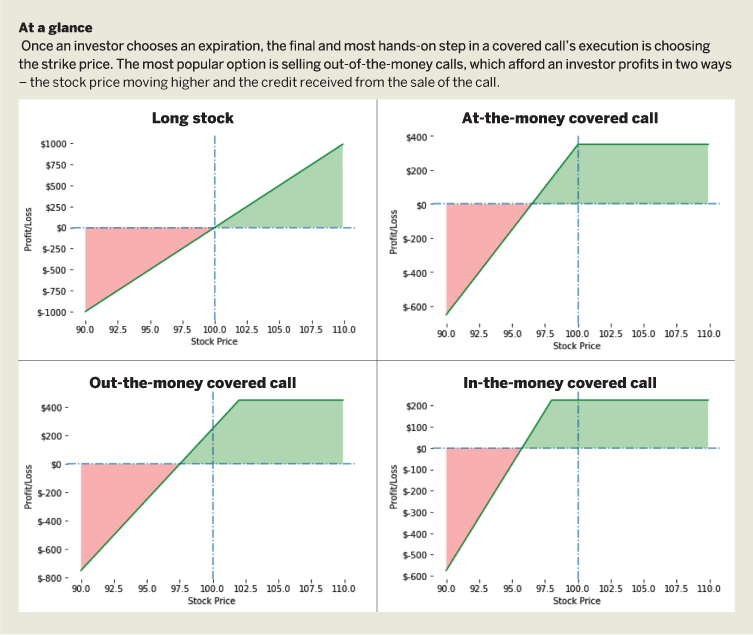

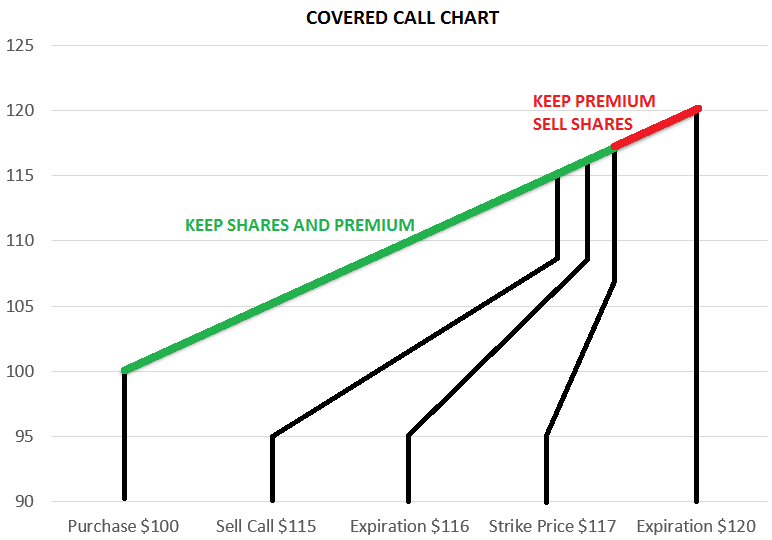

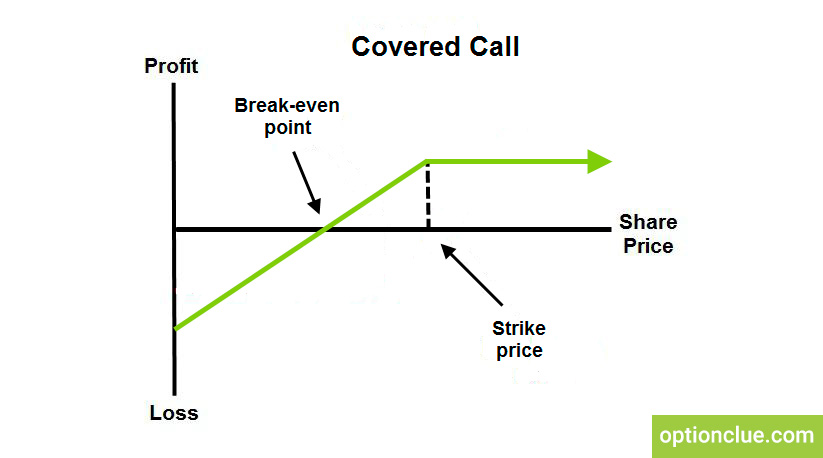

1) during periods of market overvaluation, where the market is likely to be flat or down for a while. When we open a this strategy, we are selling a call option at a specific strike price. Once you sell the call.

The key to success in covered call strategies is to pick the right company to sell the option on. The best times to sell covered calls are: Different brokers have different ways to approve you.

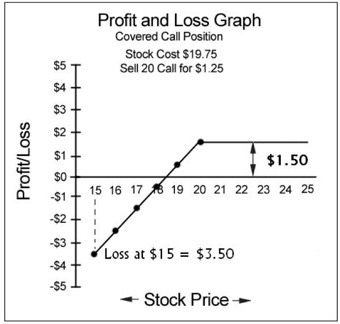

Learn more in a free video You can sell enough contracts to cover your entire underlying position. When trading a covered call, you, as an investor, will sell a call option contract on shares you already own.

The short answer is that you sell a call option on a stock you own. You determine the price at which you’d be willing to sell your stock. You sell a call option with a strike price near your.

The covered call strategy requires that we have at least one hundred shares in our portfolio to carry it out. But if you sell a weekly call credit spread with the short leg at 375 and the long leg at 380, you can make $0.8/spread. Next, search for the stock for.

:max_bytes(150000):strip_icc()/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

/TheBasicsofCoveredCalls-e9b54e56a9c74812b728f6c4585e4192.jpg)

:max_bytes(150000):strip_icc()/CoveredCalls2-88bcf551e2384215b1f8590a37c353d5.png)

![What Is A Covered Call? [Infographic] – Accessible Investor](https://accessibleinvestor.com/wp-content/uploads/2020/07/Covered-call-diagram-what-is-a-covered-call-AccessibleInvestor.com_.png)

:max_bytes(150000):strip_icc():gifv()/Cover-call-ADD-V1-551e4fa02e3a4af2bb0768956e8c0cc7.jpg)